Short-Term vs. Long-Term Rentals: What’s More Profitable in Turkey?

Useful Information

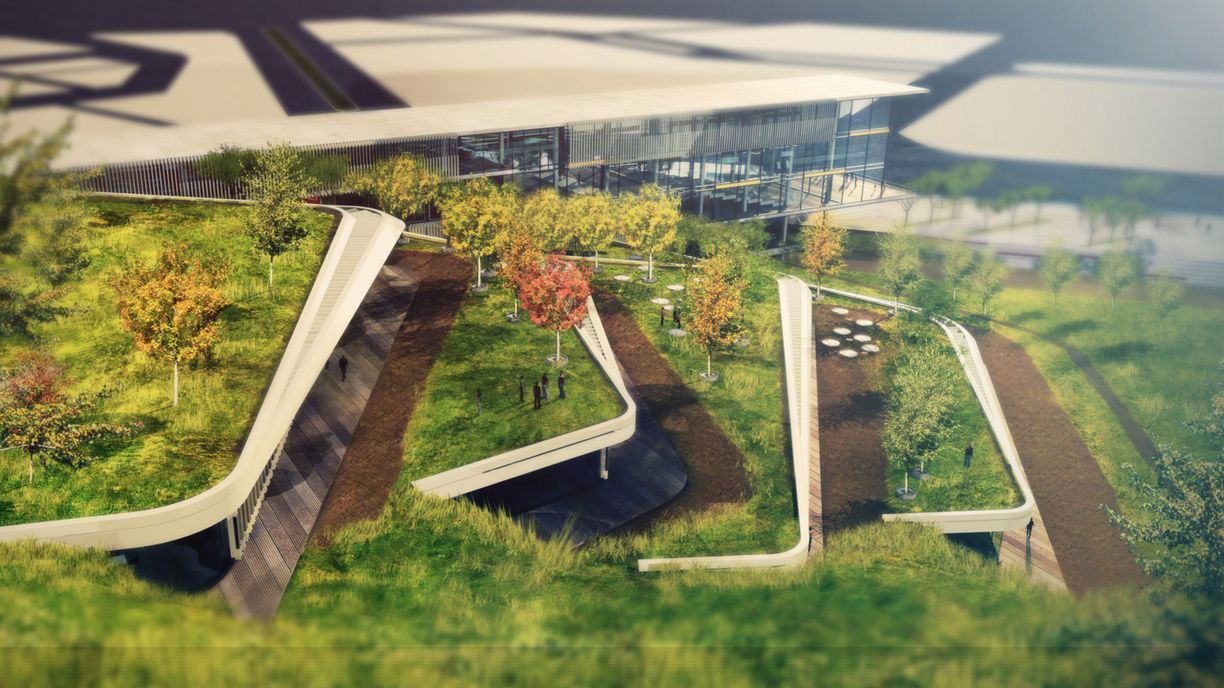

In Turkey’s rapidly evolving real estate market, the debate between short-term and long-term rentals is increasingly relevant for investors seeking the most profitable opportunities. With tourism booming in cities like Istanbul, Antalya, and Cappadocia, short-term rentals have become a lucrative option, offering high returns during peak seasons. On the other hand, long-term rentals provide stable and predictable income, offering a steady cash flow with less management effort. Each rental model has its own advantages, and choosing the right one depends on various factors, such as location, market demand, and investment goals. In this blog, we’ll explore the pros and cons of short-term vs. long-term rentals in Turkey and help you understand which option might be more profitable based on current trends and market conditions.

Pros and Cons of Short-Term Vacation Rentals (Airbnb & Similar Platforms)

Short-term vacation rentals, such as those listed on Airbnb and similar platforms, offer several benefits but also come with certain challenges. Pros include the potential for high rental yields, especially in tourist-heavy locations like Istanbul or coastal cities. During peak seasons, short-term rentals can command premium rates, leading to a much higher income compared to long-term leases. Additionally, property owners have the flexibility to adjust pricing based on demand, and they can use the property for personal stays between rentals. Cons, however, include higher management requirements, such as frequent cleaning, guest communication, and handling bookings, which can be time-consuming. There's also the risk of vacancy periods during off-seasons, leading to inconsistent income. Moreover, depending on the local regulations, short-term rentals might face legal restrictions or additional taxes, adding complexity to the investment. Overall, short-term vacation rentals can be highly profitable but require significant time, effort, and careful management to maximize returns.

Long-Term Rental Strategies for Steady Passive Income

Long-term rental properties are an excellent strategy for investors seeking steady passive income and financial stability. One of the main advantages of long-term rentals is the predictable monthly cash flow from tenants who sign leases for a year or more. This provides property owners with consistent rental income and less turnover compared to short-term rentals. Additionally, long-term rentals often require less hands-on management, as tenants typically handle the property's upkeep and maintenance. To maximize returns, it's important to carefully choose the right location—areas with strong demand for rental properties, such as near universities, business hubs, or public transportation, often yield the best results. Offering well-maintained properties with competitive pricing and attractive features can ensure reliable tenants and long-term occupancy. Another key strategy is inflation-proofing rents with periodic adjustments to keep up with market trends, thus preserving the investment’s value over time. While long-term rentals might not offer the high yields of short-term rentals, their stability and reduced risk make them a solid choice for building a sustainable, low-maintenance income stream.

How to Choose the Right Rental Strategy for Maximum ROI

Choosing the right rental strategy for maximum return on investment (ROI) depends on several key factors, including location, property type, and investment goals. If you're looking for quick returns and higher rental income, a short-term rental strategy may be ideal, especially in tourist-heavy areas or cities with a high influx of visitors. These properties can offer higher per-night rates and flexibility in pricing. However, short-term rentals require more frequent management, such as guest communication, cleaning, and maintenance, which can eat into profits.

On the other hand, long-term rentals are a more stable option that provides consistent monthly income with less effort. If you prefer less hands-on involvement and predictable cash flow, long-term rentals may be the way to go. They also provide the benefit of having tenants responsible for regular upkeep, which reduces the management burden.

The key to selecting the best strategy is understanding your personal preferences, time commitment, and the market dynamics of the area you're investing in. For instance, if you're investing in a booming tourist destination, a short-term rental may yield higher returns. But if you're targeting residential areas with strong rental demand, long-term rentals might offer a more steady and less volatile income. By aligning your strategy with the local market and your investment goals, you can maximize ROI while minimizing risks.